The 6th NEXTGEN CHINA 2016,Grasp Opportunity under Changeable Policy Environment and Fierce Competition

The 6th NEXTGEN CHINA 2016

April 12-13,New World Shanghai Hotel

2016 Conference Background

In the past 10 years, the market development growth of generics was twice as much as innovator drugs. In the next few years, there will be a drug patents expire peak. 1295 generic drugs will be off-patent during the year 2014 to 2018, which will affect $19.7 billion in total.

– Data from Analysis report on production and marketing of chemical pharmaceutical industry in China during 2015-2020.

There are lot of policy and regulation updates in China according to CFDA measurement. The new policy will influence the whole generics industry chain in perspective of generics application, quality improvement, clinical data requirement and internationalization.

Based on the data analysis from CFDA that there are around 5,000 pharmaceutical manufacturers in China in total, and 90% of them manufacture generics. There will be big changes and great adjustment around the year of 2018 due to the changeable policy and market environment.

The 6th NEXTGEN CHINA 2016 will gather all resource of CPhI global and essence of past five conferences to explore topics above and showcase evolving generics landscape & solutions.

Conference Structure

|

Day One (April 12, 2016) |

Chapter One: Regulation and Policy Discussion |

|

Chapter Two: Market and Competition | |

|

Day Two (April 13, 2016) |

Chapter Three: R&D and Technology |

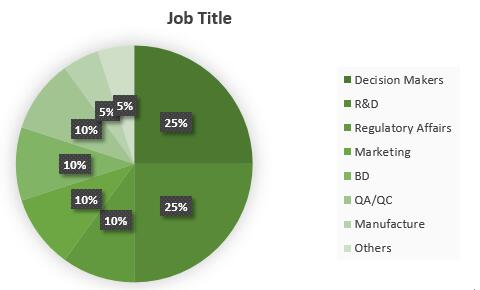

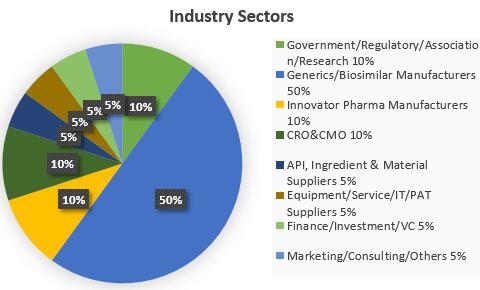

Who Should Attend

Past Attendees

Teva, Mylan, Sandoz, Pfizer, GSK, Boehringer-Ingelheim, AstraZeneca, Sanofi, Movartis, Merck, JNJ, Abbott, Bristol-Myers Squibb, Bayer, Roche, Dr. Reddy’s, Shanghai Pharma Group, Huhai, Hengrui, Yangtze River, Tasly, China Resources, Xian-Janssen, Qilu, Zhejiang Medicine, Wuhan Humanwell, Northeast Pharm, North China Pharmaceutical, Sinopharm, Kelun Group…

>> Please refer to the whole list of past attendee including Name, Job title Company

2016 Agenda

|

Conference Day One | |

|

0830-0900 |

Registration & Networking |

|

Chapter One: Regulation and Policy Discussion | |

|

0900-0910 |

Opening Remarks |

|

0910-0950 |

Clarifying and solutions: generics consistency evaluation on quality and efficacy

Core content clarifying of generics consistency evaluation: selection of reference product and research method

Influence of policy updates on generics manufacturers

Market competition pattern changes due to the policy updates |

|

0950-1030 |

Implementation and forecast: opportunities for generics manufacturers

Changes of bioequivalence test-shorten of development period

Updates of generics application process-speed up approvals

Forecast of the new policy implementation and the different market state |

|

1030-1050 |

Tea Break |

|

1050-1130 |

Drug Marketing Authorization Holder (MAH), feasibility analysis in China

Understanding content and essence of MAH

Positive impacts of MAH on generics R&D and innovation

Feasibility analysis of MAH implementation in China |

|

1130-1200 |

Industrial consolidation under changeable policy environment, opportunities and challenges for CROs

Opportunities for CROs due to policy updates

More responsibilities for CROs based on clinical data inspection

How to cooperate with generics manufacturers for mutual benefits |

|

1200-1240 |

Panel Discussion: Policy and regulation updates and the development of the whole generics industrial chain

Advantages and experience sharing from policy in US, EU and Japan

Supporting policies in clinical application, purchasing and bidding and medical-care system

Development bottleneck and trend for manufacturers, CROs, excipients suppliers and other industrial chain companies |

|

1240-1400 |

Lunch |

|

Chapter Two: Market and Competition | |

|

1400-1440 |

Analysis of the changing generics market in Chinese and overseas

Influence of generics quality consistency evaluation on market trend

Current situation and tendencies of Chinese generics market

Strategy adjustment like first generic drug and high-end generics |

|

1440-1520 |

Strategic cooperation and M&A-how to seek for new chances for generics manufacturers

Current situation of capital operation in generics market

To realize value maximization through strategic cooperation, investment and M&A

Trend prediction of the whole generics industry |

|

1520-1540 |

Tea Break |

|

1540-1620 |

Export to US and EU market, bottleneck and opportunists for Chinese generics manufacturers

The requirement and policy environment in US

Problems for the export to US and EU market, and solutions exploration

How to break through bottlenecks to promote formulation export |

|

1620-1700 |

International strategy discussion for Chinese generics

The gap and improvement of product R&D and quality

Marketing and brand strategy in overseas market

How to formulate the international strategy |

|

Conference Day Two | |

|

0830-0900 |

Registration & Networking |

|

0900-0940 |

Intellectual property strategy in generics development process

Importance of IP protection for generics manufacturers

IP rights dispute in generics development process

How to reply the IP dispute to speed up project setting up and R&D |

|

0940-1020 |

Innovative strategy and methods in generics R&D

Key points and strategy of project setting up

Key technology in generics R&D

Quality control approaches of generics |

|

1020-1040 |

Tea Break |

|

1040-1120 |

Standard of excipients and development for excipients suppliers

Exploring standard of excipients in 2015 pharmacopeia

Quality control of key excipients and the importance for formulation R&D

How to make improvement in perspective of key technology, product quality and service for excipient suppliers |

|

1120-1220 |

Strategy of generics impurity control and the specific methods

Regulation requirement of impurity control in generics application

Impurity control in CMC research

Specific methods of generics impurity control |

|

1220-1330 |

Lunch |

|

1330-1410 |

Panel Discussion: Bioequivalence test or dissolution test in generics R&D?

Reference of related standard and research

Requirements of regulatory bodies and problems in product application process

Analysis of advantages and disadvantages of BE test and dissolution test |

|

1410-1510

|

Testing and comparison of dissolution rate

Testing methods of multitier dissolution rate in innovative drug

Determine the parameter of quality standard

Key technologies in dissolution testing |

|

1510-1530 |

Tea Break |

|

1530-1700 |

Governing principles of BE testing and the specific practice

Exploring the principles of formulation BE testing

How to prepare the BE data and material

Resource analysis of BE testing and expansion methods

How to apply for BE for re-evaluation for listed product

How to confirm the authenticity and normativity of BE testing |

|

17001710 |

Close Remarks |

About Organizer

We serve 16 market sectors with wholly-owned subsidiary companies and JV companies in 10 offices in the major cities in mainland China, including Beijing, Shanghai, Guangzhou, Hangzhou, Guzhen and Shenzhen. We provide over 60 products and services in various categories: trade fairs, conferences, publications, websites and training. As China’s largest commercial exhibition organiser, we stage the leading events of their kind in China, most being the largest in Asia or second in the world. Our 53 exhibitions, 10 conferences, six publications and six vertical portals serve tens of thousands of exhibitors, visitors, conference delegates, advertisers, subscribers and corporations in the country and from all over the world with high value face-to-face business-matching events, quality conference programs presented by top-notch industry leaders, instant news on market and industry trends and round-the-clock online trading networks and sourcing platforms.

We serve 16 market sectors with wholly-owned subsidiary companies and JV companies in 10 offices in the major cities in mainland China, including Beijing, Shanghai, Guangzhou, Hangzhou, Guzhen and Shenzhen. We provide over 60 products and services in various categories: trade fairs, conferences, publications, websites and training. As China’s largest commercial exhibition organiser, we stage the leading events of their kind in China, most being the largest in Asia or second in the world. Our 53 exhibitions, 10 conferences, six publications and six vertical portals serve tens of thousands of exhibitors, visitors, conference delegates, advertisers, subscribers and corporations in the country and from all over the world with high value face-to-face business-matching events, quality conference programs presented by top-notch industry leaders, instant news on market and industry trends and round-the-clock online trading networks and sourcing platforms.

CPhI Conferences deliver the latest pharma market insight, in-depth case studies and exceptional networking opportunities through a programme of high-level conferences. The worldwide series of events, spanning four continents, provides the optimum forum for you to learn, make new business connections and identify the latest growth opportunities.

CPhI Conferences deliver the latest pharma market insight, in-depth case studies and exceptional networking opportunities through a programme of high-level conferences. The worldwide series of events, spanning four continents, provides the optimum forum for you to learn, make new business connections and identify the latest growth opportunities.

Hotel Info

Ballroom in 3F, New World Shanghai Hotel

Address: No. 1555 Dingxi Road, Changning District, Shanghai, China

- CPHI & PMEC China 2026: Revolutionizing Laboratory Innovation in Asia 2/13/2026

- 2026 World Radiology and Medical Imaging Conference (2026WRMI) 2/12/2026

- Pharma Partnering EU Summit 2026 2/11/2026

- Pharma Partnering US Summit 2026 2/11/2026

- BioAsia 2026 to Convene the World’s Leading Science, AI, and Industry Pioneers D 2/5/2026

- Global Medical Expo 2026 1/29/2026

- GENAP Summit 2026 1/21/2026

- LAB INDONESIA 2026 1/16/2026

- Cold Spring Harbor Asia Conference | Illuminating the Brain–a Symposium on Neura 1/13/2026

- Cold Spring Harbor Asia Conference | Autism & Neurodevelopment Disorders 1/13/2026